Feature image.jpg

Since traditional lenders often reject high-risk applications, a payday lender can help you even if you have bad credit scores.

Hundreds of options are available, and it can be challenging to find a reliable payday company. After comparing dozens of options, we have made a list of the sites that offer the best $255 payday loans, and you can choose them to meet your small cash needs.

We will review these sites and discuss everything you need to know about them. We will also discuss the steps that you will need to follow to get a payday loan. Furthermore, we will talk about the advantages and disadvantages of payday loans to help you understand their purpose. So, without any delay, let’s hop into the list and have a look at the sites we have picked for you.

Best $255 Payday Loans Online Same Day Approval [2022]

-

MoneyMutual – Overall Best Online Payday Loans, Editor’s Choice

-

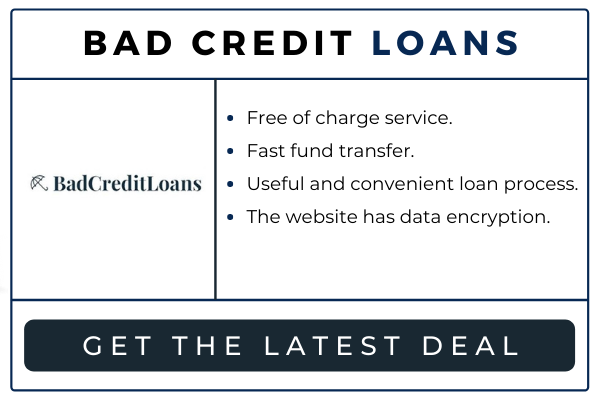

BadCreditLoans – Reliable Online Lenders For No Credit Check Loans Guaranteed Approval

-

Cash Advance -Get Instant Payday Loans Approval With Fast Cash Advance

#1. MoneyMutual – Overall Best Online Payday Loans, Editor’s Choice

moneymutual sdmag.png

MoneyMutual is one of the most trustworthy companies in the industry, and it offers loans ranging from $100-$5,000. The company has been in business for years, and it has served 2+ million clients. It offers a safe and secure website, and the team doesn’t share the personal data of clients with unreliable third-party service providers.

MoneyMutual has 130+ lenders in its network, and all of them are trustworthy, as the company doesn’t work with unreliable lenders. You can submit a loan application at any time of the day, and you won’t have to worry about hidden charges while working with them, as the company offers transparency to clients.

MoneyMutual offers free services to borrowers, and you can reject a loan offer if you don’t like it. Since they work with a large number of lenders, you are likely to find a suitable option. The company does an excellent job in the field of customer support, and they have also added an FAQ section to the site to help users get clarity on their doubts. The company welcomes many returning customers, and securely stores their data to help them save time while applying for a new loan.

Highlights

Well-designed website

As recommended by theislandnow, MoneyMutual’s official website is well-designed and user-friendly. You won’t face any issues while applying for a loan, even if you are visiting the site for the first time. The homepage looks appealing, and the number of online lenders is also displayed on it.

Straightforward application process

The application process on MoneyMutual’s official website is straightforward, and you can fill out the form in just five minutes. You can start the application process on the homepage by choosing the desired loan range and clicking on the ‘Get Started’ button. If your loan application gets accepted, you will be transferred to the lender’s website, and MoneyMutual won’t get involved in customer-lender disputes after that.

Fast service

MoneyMutual is known for offering fast service. Their lenders make fast decisions, and if your application gets approved, you may receive a loan offer in just a few hours. According to the company’s official site, you can get money in your account in as little as 24 hours.

=> Click here to visit the official website of MoneyMutual

Pros

-

Fast and free service

-

Secure platform

-

Simple application process

-

Easy-to-navigate site

Cons

-

The company doesn’t get involved in client-lender disputes

#2. BadCreditLoans – Reliable Online Lenders For No Credit Check Loans Guaranteed Approval

bad credit loans sdmag.png

BadCreditLoans is a well-known name, and it offers quality services. It’s an ideal platform for people having poor credit scores. The homepage looks simple; however, the website is easy to navigate, and you are unlikely to face any issues while filling out the form.

You can borrow any amount under $10,000 on the company’s official site in three simple steps. You will just need to fill out their online form, compare the available offers, and sign the agreement if you like the offer.

If your loan application gets approved, you may get a loan offer in minutes. But if none of the available lenders agrees to work with you, the company will offer debt relief, credit repair, and credit-related products/services. BadCreditLoans offers excellent customer support, and you can contact them via email or call if you face any issues while getting a loan.

Highlights

Advanced encryption technology

BadCreditLoans uses advanced encryption technology, and their official site is safe to use. There is no need to think twice while sharing your personal and banking information on the site.

24/7 service

The company offers 24/7 services, which makes it a reliable option for emergencies. You can visit the official website anytime you want and fill out the form.

Free service

BadCreditLoans doesn’t charge borrowers for submitting a loan application. It means you won’t have to think twice while rejecting a loan offer if you don’t like it. You can submit a new application and look for other lenders.

=> Click here to visit the official website of BadCreditLoans

Pros

-

Excellent customer support

-

Fast approval

-

The form is easy to fill

-

User-friendly policies

-

Complete transparency

Cons

-

The homepage doesn’t look too appealing

#3. Cash Advance

Cash Advance has been in business since 1997, and it’s one of the leading companies today. It’s a reliable company, and it offers free services. Cash Advance isn’t a lender, but the company can connect you with potential lenders.

Eligible users can borrow any amount up to $10,000 on the company’s official website. Their online form is easy to fill, and you can submit your loan application in minutes. Some people receive a loan offer minutes after submitting their application; however, the process can take longer in some cases. You may also see ads for other credit-related services on the platform, and you can go for them if you want.

Cash Advance has highly-trained support staff for users, and you can contact them during operational hours via call or email. All in all, Cash Advance is an ideal platform for people having a poor credit score, and you can work with the company without worrying about any safety-related issues.

Highlights

Large network of lenders

Cash Advance has a large network of lenders, and most users find a suitable lender while working with them. They send all details provided by the user to the available lenders, and most eligible users receive a loan offer. However, if someone doesn’t get a loan offer, the company helps him by providing offers related to credit repair and debt relief.

256-bit encryption

Cash Advance uses 256-bit encryption, which means your data will remain safe on the platform. They are a member of the OLA (Online Lenders Alliance), and they take every possible step to ensure a safe experience for their clients.

=> Click here to visit the official website of Cash Advance

Pros

-

The company prioritizes client safety over everything else

-

Highly-professional support staff

-

No service charges

-

Ideal for people having a bad credit score

Cons

-

The user interface doesn’t look too eye-catching

So, these are some companies that you can choose if you are looking for the best $255 payday loans online. All of them offer quality services, which means you can rely on them in emergencies. Also, we have kept the reviews completely unbiased, and you can make a decision based on them.

However, if you haven’t got a loan before, you may not know what to look for while comparing the available options. In the following section, we will discuss the important factors that you should consider while getting a payday loan.

How We Made This List For The Best $255 Payday Loans Online Same Day Direct Deposit ?

-

Service quality

Service quality was our top priority while comparing different companies because we want you to have a good experience while getting a loan. Some companies don’t process the loan in the promised time, and such delays can prove costly for clients. We didn’t pick such service providers. The payday companies we have chosen do well in almost every field, so you can work with any of them without having any second thoughts.

-

Transparency

Some unreliable companies don’t offer complete transparency to clients, and we didn’t add them to our list. People often end up paying hidden charges while working with them as they don’t mention all details clearly on the website/agreement. The companies we have chosen offer complete transparency to users, and they follow a customer-friendly approach.

-

User interface and application process

The user interface of the website plays an important role while applying for a loan. If the website is well-designed, users won’t face any issues during the process, and they will be able to finish the process quickly. This is why we have chosen companies that have easy-to-navigate websites to offer. We also checked the application process on different sites and chose the ones that don’t waste the user’s time.

-

No service charges

People apply for a loan only when they need money, which is why we have chosen the companies that offer free services. You won’t have to spend money to fill out the form and submit your loan application on these sites, as they don’t charge borrowers. However, you may have to pay the processing fee to the lender if your loan application gets approved.

Well, these were the main factors on our priority list when choosing the best payday companies. We have paid attention to every little detail while making this list, so you can rely on us. Now, let’s jump into the review section and see what these sites have to offer.

Factors to Consider While Getting a Payday Loans & Same Day Loans Easy Approval

-

Company’s reputation

You can find many lending companies online and offline, and it’s important to know that not all companies are reliable and trustworthy. So, company reputation should be your first priority while getting a loan online. You can get scammed if you choose an unreliable platform/company. Some companies just collect the personal data of users and stop replying after collecting the required details.

Scammers also ask borrowers to pay a processing fee and don’t process the loan after receiving their hard-earned money. Moreover, they don’t let users review the terms and conditions carefully before signing the agreement.

If you get scammed in an emergency, things can become even more challenging. You can avoid safety issues by choosing a well-known and trustworthy service provider.

Popular sites offer complete transparency to clients, as they have a reputation to protect, and they also offer quality services. You can rely on them in emergencies, as they process loans on or before the promised time. The sites that we have chosen are popular, and you can choose them without thinking twice.

-

Terms and conditions

Time is a crucial factor in emergencies, but you shouldn’t rush into anything. You should never get a loan without reading the terms and conditions carefully and understanding them properly. It will be one of the most important steps even if you choose a trustworthy service provider.

Fortunately, popular companies usually give some time to borrowers to review the loan offer before signing the agreement, and they mention all the details clearly. Penalty charges, processing fees, interest rate, due dates, and other important details are mentioned in this section, and you should make the deal final only if you find the terms reasonable.

You should also be clear about the tenure before signing the agreement. The tenure for short-term loans usually varies from 1-3 months, and most payday companies ask users to repay the borrowed amount within a month. Once you sign the agreement, you won’t be able to make any changes to the terms and conditions. If you fail to follow the terms, you may get in trouble.

-

Interest rate and other applicable charges

You should be clear about the interest rate and other applicable charges while getting a loan. Most lenders apply a processing fee, which varies from 1%-3% in most cases; however, the number can be higher or lower depending upon the lender you choose. Some lenders deduct the processing fee from the loan amount to make the process smoother for borrowers, and in some cases, people have to pay the fee when their loan gets approved.

Interest rates also vary on different platforms. Factors such as credit score, tenure, and loan amount can affect the applicable interest rate. Penalty charges (late payment charges) are also applicable in most cases when people fail to pay the installments on time. You won’t have to worry about penalty charges if you are confident about your ability to pay back the borrowed amount on time.

Some companies also apply early payment (pre-closure) charges. They apply extra charges if a borrower wants to pay off the loan before the chosen date. If you work with such a company, you should have an idea about the applicable charges and make the required calculations before making a decision.

-

Offered limits

You should always check the offered limits while comparing different platforms. Some companies offer flexibility in this area and allow users to borrow any amount within the $100-$5,000 range, but on some platforms, users can’t borrow an amount less than $500-$1,000. If you have to borrow a small amount of money, the upper limit won’t play an important role, and you should keep an eye on the lower limit.

-

Privacy and security

How often do you check out the ‘Privacy Policies’ section on a site? Well, most people don’t pay attention to such little detail while working with a service provider, but it’s important to read the privacy policies while working with a payday company.

You will need to share your personal and banking information on the company’s official website while applying for a loan. They will need your personal details for verification purposes, and you will also need to enter your bank account number and other details to receive money. In short, you can’t get a loan without sharing the required details on the platform. But it isn’t safe to share such details on unreliable platforms. If the company works with unreliable third-party service providers, your data won’t be safe.

Many people start receiving messages and emails having misleading links after sharing their data on such platforms. If you read the privacy policies before taking action, you are unlikely to face such issues. You should always choose a site that protects every user’s data and offers a safe experience to clients.

-

Eligibility

Eligibility is another important factor to consider, as the eligibility criteria vary from platform to platform. The basic requirements are the same on most platforms. Most companies offer loans only to US citizens who are at least 18 years old. You will also need to upload a few documents, including ID and income proof.

Some companies also have a few special requirements, such as minimum income and credit score. Existing loans can also make it difficult for you to get a new payday loan.

You should always check the eligibility criteria before filling out the form. If you don’t have the required documents, or you don’t meet the mentioned requirements, there is no point in filling out the form. It will be a waste of time, as your application will get rejected. In such a case, you should look for other platforms that suit your needs. Also, you should never enter the wrong details while applying for a loan. You can get in trouble in such a case.

-

Customer support

If everything goes smoothly, you won’t have to contact the support staff. Unfortunately, problems can get in your way at any time, and you will have to rely on the support team in such a case. You will also need to contact them if you have any queries during the repayment process. To be on the safe side, you should choose a company that offers excellent customer support.

Some companies offer 24/7 support, and their support staff is always available for clients. On the other hand, some companies get in touch with users only during operational hours on working days, and the operational hours vary from company to company. You should check such details beforehand to ensure a smooth experience.

You should also be clear about the modes of communication offered by the payday company. Most companies offer email support, and some offer chat and phone support too. It’s also important to ensure that the team responds quickly to clients. If they take a lot of time to respond, the experience can be frustrating.

-

Time for funding

Delays can be frustrating while getting a loan, and they are unacceptable in emergencies. If you need money urgently, you should look for a company that offers fast services. The funding time usually varies from 24 hours to 72 hours; however, some companies offer same-day loans too, and they are perfect for people who need money urgently. Some companies take days/weeks to process loans, and you shouldn’t choose them in emergencies.

Well, these were the important factors you should consider while getting a payday loan. If you keep these things in mind, you are likely to find a suitable option, and everything will go smoothly. If you don’t know how to get a payday loan, make sure to read the following section carefully.

How to Apply for a Payday Online Loans For Bad Credit?

-

Get your credit report

You should always get your credit report before applying for a loan. It will help you check your credit score. If your score is good, you can enjoy appealing interest rates. On the other hand, if you have a poor credit score, lenders may charge high-interest rates. If you don’t have any idea about your credit score, you won’t know if the applied interest rate is reasonable or not.

-

Calculate how much you need

You shouldn’t apply for a loan without making the required calculations, as it can be bad for your financial condition. You should calculate how much you need to borrow, and you should borrow the same amount even if you are eligible for a higher amount. Some people borrow as much as they can, which isn’t the right approach, as there is no point in paying interest on the amount you don’t need.

You should know that you will have to pay back the borrowed amount on the due date, and the total interest can vary depending on the principal amount. If you borrow a huge amount of money, you will need to pay more money in the form of interest, which will worsen your financial condition.

-

Calculate how much you can pay back on or before the due date

You should be clear about your ability to pay back the amount when you borrow money. The lender will choose a due date, and you will have to pay the installment/full amount on or before it. If you fail to do it, you will have to pay late payment charges, which is the last thing you would want.

The term length for most short-term loans is just 1-3 months, and it can be difficult to pay back a huge amount in such a small period. If your financial condition isn’t good, things can be even more challenging. So, you should borrow an amount that you can easily pay back on the due date.

-

Choose a suitable platform/company

After making all the required calculations, you should start comparing different websites/companies. You should pay attention to every little detail during the process and consider the factors we discussed above. Once you find a suitable platform, you can proceed to the next step.

-

Fill out the form and wait for a response

Once you find a suitable platform, you can fill out the form. You will need to provide a few details and upload the required documents during the process. You will also need to enter the desired amount that you want to borrow.

After entering all details, you should check everything and apply. If you choose a popular company, you may receive a response within 24 hours. Some companies accept loan applications and connect borrowers to lenders within minutes/hours.

You should know that your loan application can get rejected even if you are eligible. But if your application gets approved, you will get a loan offer.

-

Review the loan offer carefully

If you get a loan offer, you shouldn’t accept it without reading all the details carefully. The lender may make changes to your form, and other important details such as interest rate and due dates will also be mentioned in the agreement. If you like the offer, you can make the deal final and get the amount credited to your bank account.

On the other hand, if you don’t like the offer, you can request the lender to make some changes. You can also reject the offer if you want and look for other lenders.

-

Pay back the borrowed amount on time

After getting the desired amount, you should pay it back as soon as possible. If early payment charges are mentioned in the agreement, you should pay off the loan on the due date. You shouldn’t delay the payment, as lenders often apply high penalty charges on payday loans.

Well, these were the steps you will have to follow to get a payday loan. A lot of people rely on payday loans, as they have several advantages to offer. In the next section, we will talk about the advantages of payday loans.

Advantages of Payday Loans Online

-

Ideal for people having a bad credit score

People having a bad credit score usually find it hard to get a loan, as most traditional lenders reject their loan applications. Traditional lenders usually do not accept high-risk applications, as they don’t feel confident about the borrowers’ ability to pay back the money. But things are different when we talk about online payday loans.

Payday companies usually lend money to people having a bad credit score too, which makes them an ideal option for a wide range of people. You can apply for a payday loan if you have a poor credit history, but improving your credit score should also be on your priority list. It will help you get loans with low-interest rates in the future.

-

Convenience

Convenience is a major advantage of online payday loans. If you go the traditional way, you will have to visit the bank to fill out the form, which can be a time-consuming process. But when we talk about online payday loans, everything can be done sitting on the couch. You won’t have to meet anyone in person.

The application process is also simple in most cases. On some platforms, users can fill out the application form in just five to ten minutes. The repayment process is also simple, and you can pay the installments online.

-

No need to provide purchase proof

Once the money lands in your bank account, you can use it for any purpose you want. You can use it to travel, buy something, or pay bills. You won’t be asked to provide proof of purchase in most cases. However, you may have to select the ‘Loan Reason’ while filling out the form. Multiple options are available under this category, and if you don’t find a suitable option, you can choose ‘Others’.

Well, you won’t have to upload purchase proof on the site, but it doesn’t mean you should spend the borrowed money on unimportant things. You should understand the purpose of a payday loan. They are designed for emergencies, and you should treat them the same way.

-

Fast approval

In earlier times, people had to wait for days to receive money after applying for a loan. But things have changed now, and you can get the amount in your bank account in just 24-72 hours. Most payday companies offer fast approval, and some offer instant approval, which means you can get the money on the same day.

-

24/7 availability

Many payday companies offer 24/7 services, which means you can get a loan at any time of the day while working with them. You will just need to visit their official website and fill out the form to start the process. Some companies don’t operate during weekends, and you should check the operational hours while working with them.

-

You won’t have to borrow money from friends/family

Anyone can face financial problems, and things can be challenging in such situations. Some people don’t like sharing their personal problems with their friends or family members, and they are unlikely to borrow money from them. Well, payday loans can help them in emergencies, and they won’t get embarrassed. They can pack back the amount, and nobody will get to know about it.

Well, these are the major advantages of payday loans. If you need money urgently, you can get the best $255 payday loans from the companies we have reviewed. But you shouldn’t apply for a loan every other month, as it won’t be good for your financial condition. Let’s discuss the disadvantages of payday loans.

Disadvantages of Payday Loans Online

-

High-interest rates

Unfortunately, payday loans come with high-interest rates. Some people don’t realize how much interest they are paying, as many lenders follow clever marketing tricks and mention only daily or monthly interest rates. They don’t mention the annual interest rate, and borrowers get tricked. On some platforms, the annual interest rate is higher than 500%; however, you can easily find better deals on some sites. Also, payday loans usually come with a short-term length, so the annual interest rate doesn’t play a big role.

Payday loans can help you in challenging situations, and you can apply for them in emergencies. If you pay back the amount on time and create a financial cushion for the future, you won’t face any issues in the long run.

-

Upfront charges

As mentioned above, you will have to pay a processing fee while getting a loan. The charges can be different on different platforms; however, the fee usually varies from 1-3%. If you are borrowing a large amount of money, you may have to pay a significant amount as the processing fee. But if you want to borrow a small amount, the fee is likely to be small.

-

High penalty charges

When we talk about payday loans, most lenders apply high penalty charges. If you fail to make the payments on time, you can easily get trapped in a cycle of debt. However, if you keep paying the installments on or before the due date, you won’t face any issues.

-

The habit trap

Payday loans are ideal for emergencies, but some people apply for a new loan every other month when they realize how easy it is to get a loan. Getting multiple loans to buy unimportant things is one of the worst things you can do for your financial condition. You should understand the purpose of a loan and apply for one only when you don’t have any other option. Also, you should try to pay off the existing loans before applying for a new one.

So, these are the disadvantages of payday loans. Everything has a positive and negative side, and the same is the case with loans. But if you stay careful and create an effective plan, they can help you in several ways.

FAQs On $255 Payday Loans Online No Credit Check Instant Approval

Q1. Are online payday loans safe?

If you choose a trustworthy service provider/lender, you are likely to have a safe experience. They take all required steps to ensure a safe environment for clients. But you should know that scammers are everywhere in today’s world, and not every company is reliable. You can face safety issues if you choose such a company.

Q2. How can I avoid getting trapped in a cycle of debt?

People who fail to understand the purpose of a loan and don’t spend the borrowed money wisely often get trapped in a cycle of debt. If you want to avoid such issues, you shouldn’t apply for multiple loans together. You should pay off your existing loans and credit card bills before getting a new loan. Also, you shouldn’t borrow more than you need, as you are likely to end up buying something unimportant in such a case. The debt-to-income ratio should also be in your mind while borrowing money.

Q3. How can I repay my loan?

When you get a loan, the company will offer the available payment modes. Some companies provide multiple payment methods, and you can choose the option that suits you the most. The process will be online, and you can make the payments sitting at home.

Q4. Are there any alternatives to payday loans?

If you don’t want to get a payday loan, you can go for bad credit loans or other kinds of loans. Also, if you are on good terms with your friends, family members, or employer, you can borrow money from them. However, if you need money for a short period and you are confident about your ability to make the repayment on time, getting a payday loan can be a good option.

Q5. What will happen if I fail to make a payment on time?

Most companies apply late payment charges when people fail to make payments on time. You should always try to pay back the amount on time, as late payments can affect your credit score, and penalty charges will also be added to the due amount.

Conclusion: What Are The Best Online Payday Loans For $255?

No loan is too small in emergencies, and if you are looking for the best $255 payday loans online, you can pick any of the companies we have chosen. Even if you need a higher amount, these companies can help you, as they offer flexibility in this field.

If you have read this article carefully, you will know how to get a payday loan online. You will also be clear about its advantages and disadvantages, and it will be easy for you to make the right decision. If you get loans every other month, your financial condition is unlikely to improve. But if you borrow and spend money wisely, a loan can help you in challenging situations.